I am reprinting this in its entirety because it is amazing and I want to never forget it. However, if you like it you should probably click the link to the original posting.

http://www.ribbonfarm.com/2009/10/07/the-gervais-principle-or-the-office-according-to-the-office/

by Venkat on October 7, 2009

My neighbor introduced me to The Office back in 2005. Since then, I’ve watched every episode of both the British and American versions. I’ve watched the show obsessively because I’ve been unable to figure out what makes it so devastatingly effective, and elevates it so far above the likes of Dilbert and Office Space. Until now, that is. Now, after four years, I’ve finally figured the show out. The Office is not a random series of cynical gags aimed at momentarily alleviating the existential despair of low-level grunts. It is a fully-realized theory of management that falsifies 83.8% of the business section of the bookstore. The theory begins with Hugh MacLeod’s well-known cartoon, Company Hierarchy (below), and its cornerstone is something I will call The Gervais Principle, which supersedes both the Peter Principle and its successor, The Dilbert Principle. Outside of the comic aisle, the only major and significant works consistent with the Gervais Principle are The Organization Man and Images of Organization. (p.s. Slashdotters: I just posted a welcome/intro to this blog and some responses here).

I’ll need to lay just a little bit of groundwork (lest you think this whole post is a riff based on cartoons) before I can get to the principle and my interpretation of The Office. I’ll be basing this entire article on the American version of the show, which is more fully developed than the original British version, though the original is perhaps more satisfyingly bleak. Keep in mind that this is an interpretation of The Office as management science; the truth in the art. Literary/artistic critics don’t really seem to get it (Slate’s Dana Stevens, for instance is content to merely to pigeonhole it as “one of the funniest, saddest, wisest TV comedy series of all time.”) I’ll have some passing comments to offer on the comedy and art of it all, but this is primarily about the truths revealed by the show, pursued with Dwight-like earnestness.

From The Whyte School to The Gervais Principle

Hugh MacLeod’s cartoon is a pitch-perfect symbol of an unorthodox school of management based on the axiom that organizations don’t suffer pathologies; they are intrinsically pathological constructs. Idealized organizations are not perfect. They are perfectly pathological. So while most most management literature is about striving relentlessly towards an ideal by executing organization theories completely, this school, which I’ll call the Whyte school, would recommend that you do the bare minimum organizing to prevent chaos, and then stop. Let a natural, if declawed, individualist Darwinism operate beyond that point. The result is the MacLeod hierarchy. It may be horrible, but like democracy, it is the best you can do.

The “sociopath” layer comprises the Darwinian/Protestant Ethic will-to-power types who drive an organization to function despite itself. The “clueless” layer is what Whyte called the “Organization Man,” but the archetype inhabiting the middle has evolved a good deal since Whyte wrote his book (in the fifties). The losers are not social losers (as in the opposite of “cool”), but people who have struck bad bargains economically – giving up capitalist striving for steady paychecks. I am not making this connection up. Consider this passage from OM (I haven’t yet gotten to this part in my ongoing series about the book):

Of all organization men, the true executive is the one who remains most suspicious of The Organization. If there is one thing that characterizes him, it is a fierce desire to control his own destiny and, deep down, he resents yielding that control to The Organization, no matter how velvety its grip… he wants to dominate, not be dominated…Many people from the great reaches of middle management can become true believers in The Organization…But the most able are not vouchsafed this solace.

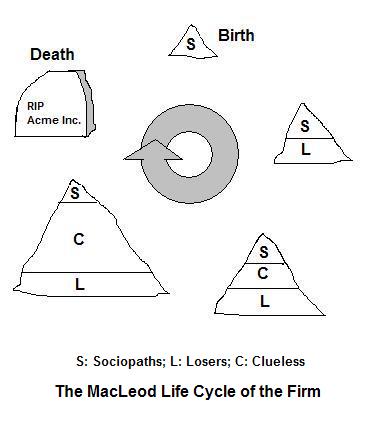

Back then, Whyte was extremely pessimistic. He saw signs that in the struggle for dominance between the sociopaths (whom he admired as the ones actually making the organization effective despite itself) and the middle-management Organization Man, the latter was winning. He was wrong, but not in the way you’d think. The Sociopaths defeated the Organization Men and turned them into The Clueless not by reforming the organization, but by creating a meta-culture of Darwinism in the economy: one based on job-hopping, mergers, acquisitions, layoffs, cataclysmic reorganizations, outsourcing, unforgiving start-up ecosystems, and brutal corporate raiding. In this terrifying meta-world of the Titans, the Organization Man became the Clueless Man. Today, any time an organization grows too brittle, bureaucratic and disconnected from reality, it is simply killed, torn apart and cannibalized, rather than reformed. The result is the modern creative-destructive life cycle of the firm, which I’ll call the MacLeod Life Cycle.

A sociopath-entrepreneur with an idea recruits just enough losers to kick off the cycle. As it grows it requires a clueless layer to turn it into a controlled reaction rather than a runaway explosion. Eventually, as value hits diminishing returns, both the sociopaths and losers make their exits, and the clueless start to dominate. Finally, the hollow brittle shell collapses on itself and anything of value is recycled by the sociopaths according to meta-firm logic.

MacLeod’s “Loser” layer had me puzzled for a long time, because I was interpreting it in cultural terms: the kind of person you call a “loser.” While some may be losers in that sense too, they are primarily losers in the economic sense: those who have, for various reasons, made (or been forced to make) a bad economic bargain: they’ve given up some potential for long-term economic liberty (as capitalists) for short-term economic stability. Traded freedom for a paycheck in short. They actually produce, but are not compensated in proportion to the value they create (since their compensation is set by sociopaths operating under conditions of serious moral hazard). They mortgage their lives away, and hope to die before their money runs out. The good news is that losers have two ways out, which we’ll get to later: turning sociopath or turning into bare-minimum performers. The losers destined for cluelessness do not have a choice.

Based on the MacLeod lifecycle, we can also separate the three layers based on the timing of their entry and exit into organizations. The sociopaths enter and exit organizations at will, at any stage, and do whatever it takes to come out on top. The contribute creativity in early stages of a organization’s life, neurotic leadership in the middle stages, and cold-bloodedness in the later stages, where they drive decisions like mergers, acquisitions and layoffs that others are too scared or too compassionate to drive. The are also the ones capable of equally impersonally exploiting a young idea for growth in the beginning, killing one good idea to concentrate resources on another at maturity, and milking an end-of-life idea through harvest-and-exit market strategies.

The Losers like to feel good about their lives. They are the happiness seekers, rather than will-to-power players, and enter and exit reactively, in response to the meta-Darwinian trends in the economy. But they have no more loyalty to the firm than the sociopaths. They do have a loyalty to individual people, and a commitment to finding fulfillment through work when they can, and coasting when they cannot.

The Clueless are the ones who lack the competence to circulate freely through the economy (unlike sociopaths and losers), and build up a perverse sense of loyalty to the firm, even when events make it abundantly clear that the firm is not loyal to them. To sustain themselves, they must be capable of fashioning elaborate delusions based on idealized notions of the firm — the perfectly pathological entities we mentioned. Unless squeezed out by forces they cannot resist, they hang on as long as possible, long after both sociopaths and losers have left (in Douglas Adams’ vicious history of our planet, humanity was founded by a spaceship full of the Clueless, sent here by scheming Sociopaths). When cast adrift in the open ocean, they are the ones most likely to be utterly destroyed.

Which brings us to our main idea. How both the pyramid and its lifecycle are animated. The dynamics are governed by the Newton’s Law of organizations: the Gervais Principle.

The Gervais Principle and Its Consequences

The Gervais Principle is this:

Sociopaths, in their own best interests, knowingly promote over-performing losers into middle-management, groom under-performing losers into sociopaths, and leave the average bare-minimum-effort losers to fend for themselves.

The Gervais principle differs from the Peter Principle, which it superficially resembles. The Peter Principle states that all people are promoted to the level of their incompetence. It is based on the assumption that future promotions are based on past performance. The Peter Principle is wrong for the simple reason that executives aren’t that stupid, and because there isn’t that much room in an upward-narrowing pyramid. They know what it takes for a promotion candidate to perform at the “to” level. So if they are promoting people beyond their competence anyway, under conditions of opportunity scarcity, there must be a good reason.

Scott Adams, seeing a different flaw in the Peter Principle, proposed the Dilbert Principle: that companies tend to systematically promote their least-competent employees to middle management to limit the damage they can do. This again is untrue. The Gervais principle predicts the exact opposite: that the most competent ones will be promoted to middle management. Michael Scott was a star salesman before he become a clueless middle manager. The least competent employees (but not all of them — only certain enlightened incompetents) will be promoted not to middle management, but fast-tracked through to senior management. To the sociopath level.

And in case you are wondering, the unenlightened under-performers get fired.

Let me illustrate the logic and implications of the principle with examples from the show.

The Career of the Clueless

In Season Three, the Dunder-Mifflin executives decide to merge the Stamford and Scranton branches, laying off much of the latter, including Michael Scott. His counterpart, the competent-sociopath Stamford branch manager, whose promotion is the premise of the re-org, opportunistically leverages his impending promotion into an executive position at a competitor, leaving the c0mpany in disarray. The Dunder-Mifflin executives, forced to deal with the fallout, cynically play out the now-illogical re-org anyway, shutting down Stamford and leaving Michael with the merged branch instead. The executives (David Wallace and Jan Levinson-Gould) are obviously completely aware of Michael’s utter incompetence. But their calculations are obvious: giving Michael the expanded branch allows them to claim short-term success and buy time to maneuver out of having to personally suffer longer-term consequences.

Jim’s remark on the drama is revealing. Comparing Michael to his exiting sociopath peer he says: “Whatever you say about Michael, he would never have done something like this,” a testament to Michael’s determinedly deluded loyalty to the company that will never be loyal to him. We can safely assume that Michael’s previous promotion to regional manager occurred under similar circumstances of callous short-term calculations by sociopaths.

So why is promoting over-performing losers logical? The simple reason is that if you over-perform at the loser level, it is clear that you are an idiot. You’ve already made a bad bargain, and now you’re delivering more value than you need to, making your bargain even worse. Unless you very quickly demonstrate that you know your own value by successfully negotiating more money and/or power, you are marked out as an exploitable clueless loser. At one point, Daryl, angling for a raise, learns to his astonishment that the raise he is asking for would make his salary higher than Michael’s. Michael hasn’t negotiated a better deal in 14 years. Daryl — a minimum-effort loser with strains of sociopath — doesn’t miss a step. He convinces and coaches Michael into asking for his own raise, so he can get his.

A loser who can be suckered into bad bargains is set to become one of the clueless. That’s why they are promoted: they are worth even more as clueless pawns in the middle than as direct producers at the bottom, where the average, rationally-disengaged loser will do. At the bottom, the overperformers can merely add a predictable amount of value. In the middle they can be used by the sociopaths to escape the consequences of high-risk machinations like re-orgs.

The Career of the Sociopath

The example of the “fast-track the under-performing” part of the principle is Ryan, the intern. He tests himself quickly and rapidly learns and accepts that he is incompetent as a salesman. But he is a born pragmatist-sociopath with the drive, ambition, daring and lack of principles to make it to the top. So rather than waste time trying to get good at sales, he slips into a wait-watch-grab opportunist mode. But he isn’t checked out — he is engaged, but in an experimental way, probing for his opening. The difference between him and the average checked-out loser is illustrated in one brilliant scene early in his career. He suggests, during a group stacking effort in the warehouse, that they form a bucket brigade to work more efficiently. The minimum-effort loser Stanley tells him coldly, “this here is a run-out-the-clock situation.” The line could apply to Stanley’s entire life.

Stanley’s response shows both his intelligence and clear-eyed self-awareness of his loser-bargain with the company. He therefore acts according to a mix of self-preservation and minimum-effort coasting instincts. The same is true of everybody else in the loser layer with the exception of the over-performers: Dwight and Andy (and in his earlier incarnation as a salesperson, Michael).

The future sociopath must be an under-performer at the bottom. Like the average loser, he recognizes that the bargain is a really bad one. Unlike the risk-averse loser though, he does not try to make the best of a bad situation by doing enough to get by. He has no intention of just getting by. He very quickly figures out — through experiments and fast failures — that the loser game is not worth becoming good at. He then severely under-performs in order to free up energy to concentrate on maneuvering an upward exit. He knows his under-performance is not sustainable, but he has no intention of becoming a lifetime-loser employee anyway. He takes the calculated risk that he’ll find a way up before he is fired for incompetence.

Ryan’s character displays this path brilliantly. When Michael’s boss and dominatrix-lover Jan suffers a psychotic descent into madness, her boss, the uber-sociopath David Wallace, has no great hopes of a good outcome. Setting up yet another band-aid move, he calls up Michael for an interview to take up Jan’s spot. But when the rest of the office learns of Michael’s impending interview (during Michael’s farcical attempts at using a Survivor style contest to choose his successor, which predictably, only Dwight takes seriously), the true sociopaths act. Jim and his sociopath girlfriend Karen instantly call up David and announce their candidacies for the same position. Unknown to them, Ryan, the intern-turned-rookie has also spotted the opportunity. The outcome is spectacular: Ryan gets the job, Michael loses, Karen gets the Utica branch, and Jim — who still has not yet completely embraced his inner sociopath — returns to Scranton. We learn later — as the Gervais principle would predict — that David Wallace never seriously considered Michael more than a temporary last resort. Much later, in a deposition during Jan’s lawsuit against the company, he reveals that Michael was never a serious candidate.

The Career of the Loser

The career of the loser is the easiest to understand. Having made a bad bargain, and not marked for either clueless or sociopath trajectories, he or she must make the best of a bad situation. The most rational thing to do is slack off and do the minimum necessary. Doing more would be a clueless thing to do. Doing less would take the high-energy machinations of the sociopath, since it sets up self-imposed “up or out” time pressure. So the coasting-loser — really not a loser at all if you think about it — pays his dues, does not ask for much, and finds meaning in his life elsewhere. For Stanley it is crossword puzzles. For Angela it is a colorless Martha-Stewartish religious life. For Kevin, it is his rock band. For Kelly, it is mindless airhead pop-culture distractions. Pam has her painting ambitions. Meredith is an alcoholic slut. Oscar has his active gay lifestyle. Creed, a walking freak-show, marches to the beat of his own obscure different drum (he is the most rationally checked-out of all the losers).

If you leave out the clear marked-for-clueless characters like Dwight and Andy, you are left with the two most interesting characters in the show: the will-he-won’t-he sociopath-in-the-making, Jim, and the strange Toby. Toby is a curious case — intellectually a sociopath, but without the energy or ambition to be an active sociopath. More about these two later.

The Emergence of the MacLeod Hierarchy

Dastardly as all this sounds, it is actually pretty efficient, given the inevitability of the MacLeod hierarchy and life cycle. The sociopaths know that the only way to make an organization capable of survival is to buffer the intense chemistry between the producer-losers and the leader-sociopaths with enough clueless padding in the middle to mitigate the risks of business. Without it, the company would explode like a nuclear bomb, rather than generate power steadily like a reactor. On the other hand, the business wouldn’t survive very long without enough people actually thinking in cold, calculating ways. The average-performing , mostly-disengaged losers can create diminishing-margins profitability, but not sustainable performance or growth. You need a steady supply of sociopaths for that, and you cannot waste time moving them slowly up the ranks, especially since the standard promotion/development path is primarily designed to maneuver the clueless into position wherever they are needed. The sociopaths must be freed up as much as possible to actually run the business, with or without official titles.

So Ryan floats directly to the top, where he does what is expected of him — lead a bold strategic gamble by building an online sales channel operation (which Dwight competes with in a brilliantly Quixotic episode). As with any big strategic move, the operation has its risks, and fails. And here we find that Ryan is still not quite experienced enough as a sociopath. He foolishly goes the Enron route, attempting to cook the books to avoid failure, and is found out and arrested. A true master sociopath like David Wallace would instead have spotted the impending failure, promoted a Michael to take over (who would obviously be so gratified at being given a new white-elephant title that he would not have seen disaster looming), and have him take the blame for the inevitable failure. Completely legal and efficient.

But Ryan isn’t done yet. In the last season, he played himself back into the game, and as of the last episode, had started a college football gambling fund that sounds suspiciously like the LTCM trading strategies of Messrs. Black, Scholes and Mertens.

The Organization as Psychic Prison

Which brings us to the other major management book that is consistent with the Gervais Principle. Images of Organization, Gareth Morgan’s magisterial study of the metaphors through which we understand organizations. Of the eight systemic metaphors in the book, the one that is most relevant here is the metaphor of an organization as a psychic prison. The image is derived from Plato’s allegory of the cave, which I won’t get into here. Suffice it to say that it divides people into those who get how the world really works (the sociopaths and the self-aware slacker losers) and those who don’t (the over-performer losers and the clueless in the middle).

This is where Gervais has broken new ground, primarily because as an artist, he is interested in the subjective experience of being clueless. For your everyday sociopath, it is sufficient to label someone clueless and work around them. What Gervais managed to create is a very compelling portrait of the clueless, a work of art with real business value.

Here is the ultimate explanation of Michael Scott’s (and David Brent’s) careers: they are put into a position of having to explain their own apparent, unexpected and unexamined success. It is easy to explain failure. Random success is harder. Remember, they are promoted primarily as passive pawns to either allow the sociopaths to escape the risks of their actions, or to make way for the sociopaths to move up faster. They are presented with an interesting bit of cognitive dissonance: being nominally given greater power, but in reality being safely shunted away from the pathways of power. They must choose to either construct false narratives or decline apparent opportunities.

The clueless resolve this dissonance by choosing to believe in the reality of the organization. Not everybody is capable of this level of suspension of disbelief. Both Ricky Gervais (David Brent) and Steve Carrel (Michael Scott) play the brilliantly-drawn characters perfectly. The most visible sign of their capacity for self-delusion is their complete inability to generate an original thought. They quote movie lines, lyrics and perform terrible impersonations (at one point Michael goes, “You talking to me?” a line he attributes, in a masterful display of confusion, to “Al Pacino, Raging Bull“). For much of what he needs to say, he gropes for empty business phrases, deploying them with staggering incompetence. When Michael talks, he is attempting, like a child, to copy the flawless buzzspeak spoken by sociopaths like Jan and David Wallace. He is oblivious to the fact that the sociopaths use buzzspeak as a coded language with which to simultaneously sustain the (necessary) delusions of the clueless and communicate with each other.

It is not just the sociopaths who conspire to sustain Michael’s delusions. So do the checked-out losers, sometimes out of kindness, and sometimes out of self-interest. In one particularly perfect summing up, Oscar describes the impending “Dundees” award ceremony (a veritable monument to the consensual enablement of Michael’s delusions) as “like a child’s birthday party, he is having a lot of fun, and you just have to go and play along.” (I may be misremembering the exact line)

But Michael isn’t entirely a puppet. Buried under layers of denial is a clear understanding of his own, hopeless, powerless life, which makes him marginally more clued-in than say, Dwight. His response is frenetic and desperate manipulation of the drama of false validation that has been set up for his benefit. Some of this is with the knowing consent of his enablers. Like experienced improv-comics, within limits, the rest of the Office follows the rule of agreement in the Theater of Michael (in a brilliant piece of meta-commentary, in one episode we get to see Michael at his own impossibly bad worst in his real improv class, where he ruins every single sketch).

But Michael’s grand narrative requires constant, exhausting work to keep up. He must amplify and rope in even the most minor piece of validation into the service of his script. When, in a moment of weakness, Jim shares a genuine confidence with him, Michael is so thrilled that he turns the moment into a deep imaginary friendship, practically becoming a stalker, even mimicking Jim’s hairstyle. At the other end, he over-represses even the slightest potential dent to his self-image. His is a thin-skinnedness gone crazy. Reality is sealed away with psychotic urgency, but to do so, he must first scout it out with equal urgency. And so, when Jim (in the first true sociopath move of his career) engineers a private meeting with the visiting David Wallace to carve out a promotion, Michael first tries to break into the meeting. When politely turned away, he instantly switches scripts and pretends he is too busy and that he is the one who can’t attend. And then he sneaks into the meeting room anyway, first with various excuses, and finally by hiding in a Trojan-Horse cheese cart.

This sort of ability to work hard to sustain the theater of his own delusions, half-aware that he is doing so, is what makes Michael a genuine candidate for promotion to the ranks of the Clueless. Dwight is interesting precisely because he lacks Michael’s capacity for this pathological meta-cognition, and the ability to offer semi-believable scripts that others can at least help bolster. Dwight is not talented enough at cluelessness to ever be promoted.

Is There More

You bet. We haven’t even scratched the surface. Dwight, Jim, and Toby each deserve an entire essay. Michael and Ryan probably deserve one each as well, in addition to my quick sketches here. And there are other principles, lemmas and sundry theoretical constructs. But I’ll hold off. Maybe there aren’t as many Office watchers among this blog’s readers as I imagine. You guys tell me if you want more.

I’ll conclude with one thought: Gervais deserves Nobel prizes in both literature and economics.